- Quando cambiano i tassi, i gestori di fondi obbligazionari attivi possono modificare le esposizioni al rischio di duration e al rischio di credito per adeguarsi al nuovo contesto.

- Al variare dei tassi, anche i profili di rischio dei fondi obbligazionari attivi possono variare con l’intento di perseguire l’obiettivo di sovraperformance rispetto al benchmark.

- Gli investitori devono essere consapevoli dei rischi che i gestori obbligazionari attivi assumono nei differenti contesti di tassi di interesse e assicurarsi di considerare questi rischi nell’ambito del processo di valutazione periodica dei loro investimenti.

I tassi d’interesse sono cambiati in modo drastico dal 2022. Di conseguenza gli investitori potrebbero riscontrare cambiamenti anche nei profili di rischio dei fondi obbligazionari attivi nel nuovo contesto dei tassi nel quale i gestori perseguono l’obiettivo di sovraperformance rispetto al benchmark. Questa fase di cambio storico del quadro dei tassi può essere pertanto un momento opportuno per gli investitori per verificare i profili di rischio dei fondi obbligazionari in cui investono.

Anche se l’americana Federal Reserve (Fed) e le altre banche centrali continueranno come previsto nell’allentamento monetario, ci aspettiamo che i tassi d’interesse restino a livelli relativamente alti in confronto a quelli sperimentati nel periodo successivo alla crisi finanziaria globale del 2008. Il quadro è infatti radicalmente mutato rispetto al contesto di bassi tassi d’interesse che gli investitori hanno attraversato dal 2008 al 2022, quando i gestori hanno probabilmente incrementato l’esposizione al rischio di credito in cerca di rendimento.

Poi, dai primi mesi del 2022 a fine 2023, si sono verificati decisi rialzi dei tassi, compreso il maggiore incremento dei tassi sul decennale americano dal 1981.

Quando i tassi cambiano, gli obiettivi d’investimento dei fondi restano immutati ma i gestori potrebbero modificare le esposizioni al rischio di duration e al rischio di credito per adattarsi alla nuova fase del ciclo. Anche se l’investitore continua a essere investito sempre nello stesso fondo, questo non significa che l’esposizione al rischio resti statica. Gli investitori dovrebbero pertanto prestare attenzione agli effetti che le variazioni dei tassi d’interesse possono avere sul posizionamento di duration e di rischio di credito attuato dal gestore.

Rischio di credito e rischio di duration tendono a divergere

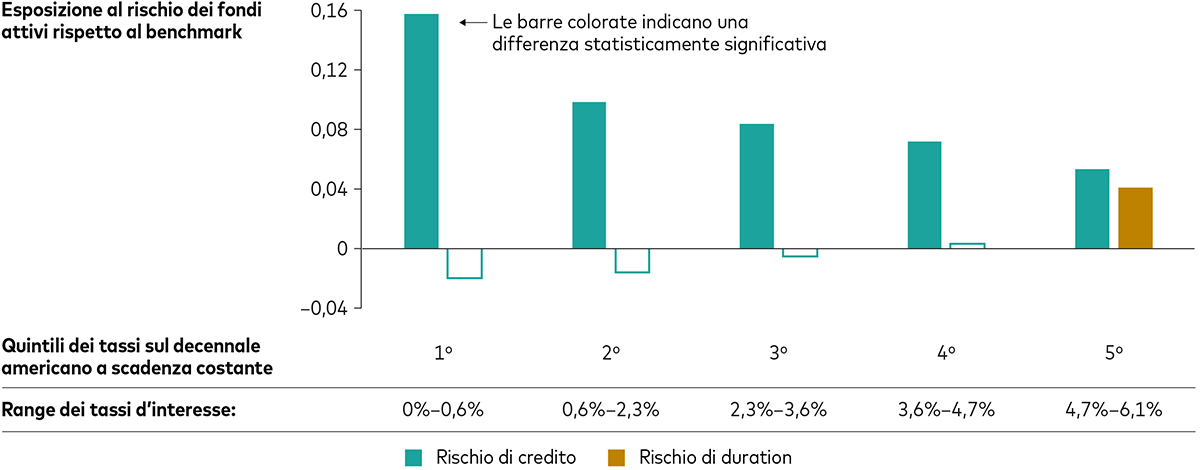

Abbiamo analizzato i profili di rischio di fondi obbligazionari americani a gestione attiva rispetto ai loro benchmark sulla base dei rendimenti mensili a livello di fondo dal 1990 al 2023. I risultati indicano che il rischio di credito dei fondi obbligazionari attivi decresce con l’aumento dei tassi. È interessante notare che il rischio di duration si è rivelato statisticamente significativo solo quando i tassi sono stati nel quintile più alto (4,7%-6,1%) nel periodo considerato.

Quando i tassi sono più bassi, il rischio di credito nei fondi obbligazionari attivi può essere più alto

Fonti: elaborazioni Vanguard sulla base di dati Morningstar, Bloomberg e FRED (dati economici della Federal Reserve americana), relativi al periodo dal 1° gennaio 1990 al 31 dicembre 2023. Sulla base dell’analisi delle 15 maggiori strategie obbligazionarie che investono in titoli denominati in dollari americani. Si veda la nota a piè di pagina per maggiori informazioni1.

Principali conclusioni

Un approccio informato all’investimento in prodotti a gestione attiva implica conoscere i rischi assunti dai gestori nei differenti contesti economici e finanziari. Alcuni investitori in fondi obbligazionari attivi potrebbero essersi abituati ai profili di rischio dei loro fondi durante il periodo prolungato di tassi bassi sperimentato dal 2008 sino all’avvio del ciclo di rialzi da parte delle banche centrali nel 2022.

Sono probabili benefici di lungo termine per gli investitori in fondi obbligazionari dal contesto di tassi più alti. Essere consapevoli dei cambiamenti del rischio di duration e del rischio di credito nei fondi attivi in questo nuovo contesto può aiutare gli investitori a mantenere un piano d’investimento informato che conferisce disciplina e aumenta la probabilità di successo negli investimenti.

È buona prassi verificare il profilo di rischio dei fondi obbligazionari attivi con l’evolvere del contesto di mercato. Gli investitori devono essere consapevoli dei rischi che i gestori di portafoglio assumono nei differenti contesti di tassi di interesse e assicurarsi di considerare questi rischi nell’ambito del processo di valutazione periodica dei loro investimenti.

1 Le barre non colorate indicano risultati non statisticamente significativi. Dati relativi al periodo dal 1° gennaio 1990 al 31 dicembre 2023. Il grafico mostra le esposizioni al rischio dei fondi obbligazionari a gestione attiva rispetto ai loro benchmark Morningstar per i cinque quintili dei tassi d’interesse dal 1990 al 2023. Il campione comprende le 15 maggiori strategie obbligazionarie che investono soprattutto in titoli denominati in dollari. Queste strategie nell’insieme rappresentano oltre il 95% del patrimonio gestito in fondi che rientrano nella categoria Morningstar degli obbligazionari americani tassabili, nel periodo in esame. Per calcolare le esposizioni al rischio di questi fondi, abbiamo calcolato il rendimento netto medio mensile dei fondi attivi ponderato per il loro patrimonio in gestione alla fine del mese precedente. Abbiamo poi classificato questi rendimenti mensili ponderati in quintili di tassi d’interesse sulla base della media mensile dei tassi d’interesse del decennale americano a scadenza costante nel mese. Per ciascun quintile, abbiamo condotto l’analisi di regressione dei rendimenti ponderati mensili corretti per il tasso privo di rischio a un mese rispetto a rischio di duration, rischio di credito e rischio di rimborso anticipato. Il rischio di duration, il rischio di credito e il rischio di rimborso anticipato sono definiti rispettivamente come differenza fra il rendimento totale del Bloomberg US Treasury Aggregate Index e il rendimento totale del Bloomberg US Short Treasury 1–3 Month Index; extra rendimento del Bloomberg US Corporate High Yield Index (rispetto ai Treasury con duration corrispondente); ed extra rendimento del Bloomberg US Mortgage-Backed Securities Index (rispetto ai Treasury con duration corrispondente). Parimenti, abbiamo valutato le esposizioni al rischio dei benchmark di questi fondi tramite analisi di regressione del rendimento mensile del benchmark ponderato per gli attivi della categoria Morningstar, con pesi determinati dalle dimensioni degli attivi delle rispettive categorie dei fondi attivi nello stesso mese, corretto per il tasso privo di rischio a un mese rispetto a rischio di duration, rischio di credito e rischio di rimborso anticipato. Le differenze tra i coefficienti di questi fattori di rischio (vale a dire, le esposizioni al rischio) per i fondi obbligazionari attivi e i loro benchmark sono state calcolate per ciascun quintile di tassi d’interesse. Le barre colorate nel grafico indicano una differenza statisticamente significativa (p-value inferiore al 10%). Questo articolo illustra i risultati solo per le esposizioni al rischio di credito e al rischio di duration in quanto i fondi attivi non hanno manifestato con regolarità esposizioni statisticamente significative per il rischio di rimborso anticipato.

I nostri fondi obbligazionari attivi gestiti internamente

Informazioni sui rischi d’investimento

Il valore degli investimenti e il reddito da essi derivante possono diminuire o aumentare e gli investitori potrebbero recuperare un importo inferiore a quello investito.

Informazioni importanti

Questa è una comunicazione di marketing.

Riservato agli investitori professionali secondo la definizione di cui alla Direttiva MiFID II. In Svizzera solo per gli investitori professionali. Da non distribuire al pubblico.

Le informazioni contenute nel presente materiale non devono essere considerate offerte di acquisto o di vendita né sollecitazioni di offerte di acquisto o di vendita di titoli in qualsiasi paese in cui tali prassi siano vietate dalla legge, né possono essere rivolte a soggetti cui non sia lecito effettuare tali offerte o sollecitazioni né possono essere effettuate soggetti non qualificati. Le informazioni contenute nel presente materiale non devono essere interpretate come consulenza legale, fiscale o d'investimento. Pertanto non ci si deve basare sui contenuti di questo materiale per eventuali decisioni d’investimento.

Le informazioni contenute in questo materiale hanno finalità puramente di carattere educativo e non costituiscono una raccomandazione né una sollecitazione ad acquistare o vendere investimenti.

Pubblicato nell’AEE da Vanguard Group (Ireland) Limited regolamentata in Irlanda dalla Central Bank of Ireland.

Pubblicato in Svizzera da Vanguard Investments Switzerland GmbH.

Pubblicato da Vanguard Asset Management, Limited, autorizzata e regolamentata nel Regno Unito dalla Financial Conduct Authority.

Pubblicato in Germania da Vanguard Group Europe GmbH.

© 2024 Vanguard Group (Ireland) Limited. Tutti i diritti riservati.

© 2024 Vanguard Investments Switzerland GmbH. Tutti i diritti riservati.

© 2024 Vanguard Asset Management, Limited. Tutti i diritti riservati.

© 2024 Vanguard Group Europe GmbH. Tutti i diritti riservati.